Decentralized Finance (DeFi)

What is DeFi?

DeFi, short for Decentralized Finance, refers to an emerging financial ecosystem built on blockchain technology that aims to remove intermediaries like banks, brokers, or traditional financial institutions. Instead, DeFi leverages smart contracts—self-executing programs on blockchain networks like Ethereum—to offer financial services such as lending, borrowing, trading, and investing in a decentralized way.

In simple terms, DeFi offers banking without banks. It creates open, permissionless platforms that anyone with an internet connection can access, without the need to go through a middleman or complete complicated paperwork.

How DeFi Works

DeFi applications run on blockchains, with the most popular one being Ethereum. At the core of these applications are smart contracts—programs that automatically execute transactions when specific conditions are met.

Here’s a simple analogy: Imagine a vending machine that releases a soda when you insert the right amount of money. That’s similar to how smart contracts work—they perform tasks only when certain conditions are fulfilled, ensuring trust between parties without needing a third party.

Key Components of DeFi

- Decentralized Exchanges (DEXs):

- These are platforms like Uniswap, PancakeSwap, and SushiSwap where users can trade cryptocurrencies directly with each other without relying on a centralized exchange like Binance or Coinbase.

- DEXs rely on liquidity pools, where users contribute their tokens to facilitate trading and earn rewards.

- Lending and Borrowing Platforms:

- Examples: Aave, Compound, and MakerDAO.

- Users can lend their crypto assets to earn interest or borrow assets by providing collateral. This process is completely automated by smart contracts, making loans fast and transparent.

- Stablecoins:

- Stablecoins are cryptocurrencies pegged to the value of traditional currencies like the US dollar (e.g., USDC, DAI). They help users avoid the volatility of other cryptocurrencies.

- Yield Farming and Liquidity Mining:

- Yield farming allows users to earn passive income by locking up their assets in DeFi platforms to provide liquidity.

- Liquidity mining rewards users with additional tokens for participating in a platform’s liquidity pools.

- Prediction Markets:

- Platforms like Augur allow users to bet on the outcome of future events, such as elections or sports events, in a decentralized and trustless manner.

Key Advantages of DeFi

- Accessibility and Inclusion:

- Anyone with an internet connection can access DeFi services. There’s no need for a bank account or credit score, making it ideal for people in unbanked or underbanked regions.

- Transparency and Trust:

- DeFi platforms are built on blockchains, which are transparent and immutable. All transactions can be verified on the public ledger, ensuring trust without relying on a centralized authority.

- Lower Costs and Faster Transactions:

- DeFi eliminates the need for intermediaries, reducing fees and processing times for financial transactions, especially for international payments.

- Ownership and Control:

- Users retain full control over their funds by using non-custodial wallets, meaning no one else can freeze or limit their accounts.

Risks and Challenges of DeFi

- Smart Contract Vulnerabilities:

- If a smart contract has a bug or security flaw, it can be exploited by hackers, resulting in the loss of user funds.

- Regulatory Uncertainty:

- Many governments are still figuring out how to regulate DeFi, which could result in sudden changes or restrictions on certain services.

- Volatility and Liquidation Risks:

- DeFi loans require collateral (usually cryptocurrencies). If the value of the collateral drops too quickly, the loan could be liquidated automatically.

- Scalability Issues:

- Blockchains like Ethereum, where most DeFi apps run, can become congested, resulting in high transaction fees (also known as gas fees) and slow transaction speeds.

- User Responsibility:

- In DeFi, users are responsible for managing their wallets and private keys. If someone loses access to their private key, they lose access to their funds permanently.

Popular DeFi Platforms to Explore

- Aave – Lending and borrowing platform with flash loans (instant, uncollateralized loans).

- Uniswap – One of the largest decentralized exchanges for swapping cryptocurrencies.

- MakerDAO – A lending platform that issues DAI, a decentralized stablecoin.

- PancakeSwap – A DEX on Binance Smart Chain known for low fees.

- Compound – A lending platform where users can earn interest by supplying crypto.

Future of DeFi: What’s Next?

- Interoperability Between Blockchains:

- New platforms like Polkadot and Cosmos aim to connect different blockchains, making it easier for DeFi apps to communicate across networks.

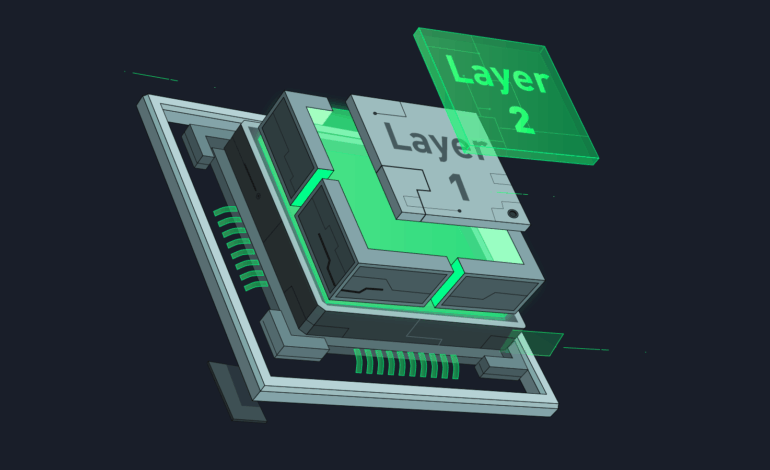

- Layer 2 Solutions:

- Ethereum’s Layer 2 networks (e.g., Arbitrum, Optimism) are being developed to reduce gas fees and improve transaction speed.

- Institutional Adoption:

- Traditional financial institutions are beginning to explore DeFi protocols for faster settlements and asset management.

- Integration with Web3:

- DeFi will likely become an essential part of the Web3 ecosystem, which aims to decentralize the internet itself.

How to Get Started with DeFi

- Create a Crypto Wallet:

- Use wallets like MetaMask or Trust Wallet to access DeFi platforms.

- Buy Cryptocurrency:

- Purchase cryptocurrencies from exchanges like Binance, Coinbase, or Kraken and transfer them to your wallet.

- Explore DeFi Platforms:

- Visit platforms like Uniswap or Aave, connect your wallet, and start trading, lending, or borrowing.

- Stay Safe:

- Do your research (DYOR) before investing in any DeFi project. Be cautious of scams and only invest what you can afford to lose.

DeFi is revolutionizing the way we think about finance by making it more accessible, transparent, and decentralized. While it comes with some risks and challenges, its potential to empower individuals by giving them more control over their finances is undeniable. As blockchain technology continues to evolve, DeFi is expected to become an integral part of the global financial ecosystem.

Whether you’re interested in lending, borrowing, trading, or earning passive income, DeFi offers something for everyone. However, it’s essential to stay informed and cautious, as the industry is still in its early stages and evolving rapidly.

1 Comment

Thanks for sharing excellent informations. Your site is very cool. I am impressed by the details that you¦ve on this blog. It reveals how nicely you understand this subject. Bookmarked this website page, will come back for extra articles. You, my friend, ROCK! I found simply the information I already searched all over the place and just could not come across. What a perfect site.