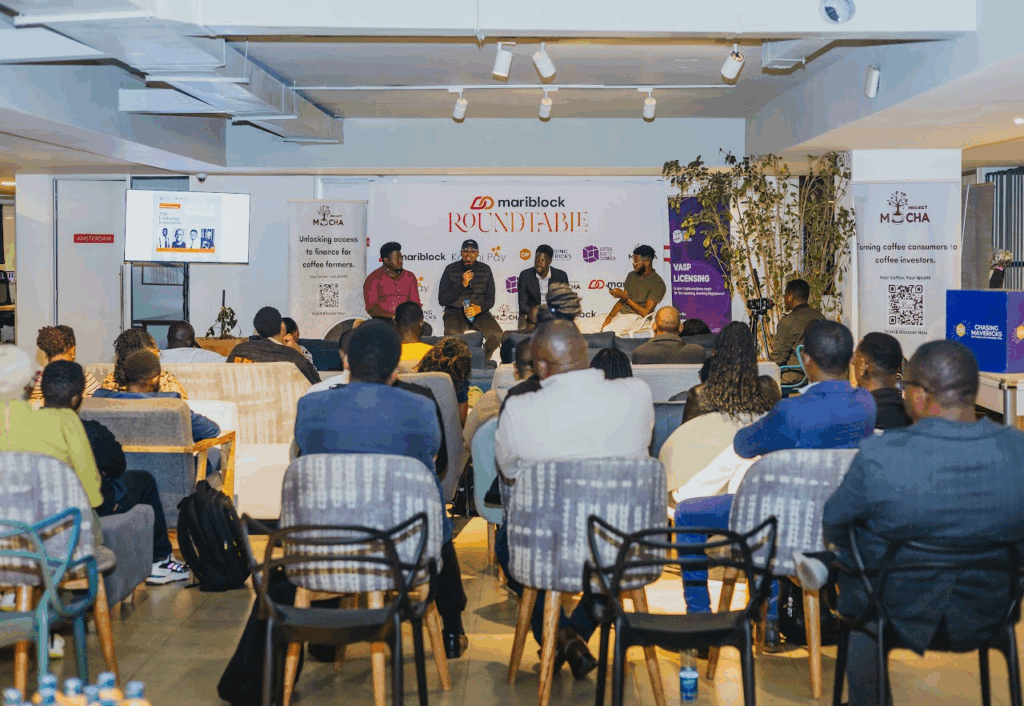

Last week, we got to have what is perhaps the most important conversation in the space. Brought to you by Mariblock, Kotani Pay , Virtual Assets Chamber & Chasing Mavericks , we discussed. what’s the role of the industry voice and what is its influence in shaping Kenya’s blockchain future. A Mariblock Roundtable conversation

Incase you weren’t in the room, don’t worry, we were.

Advocacy vs Lobbying

You don’t educate a Regulator; you ‘sensitize’

Advocacy is about raising awareness, sharing knowledge, and bridging the gap between innovators and regulators. Lobbying, on the other hand, is much more direct: it’s the art (and sometimes grind) of convincing decision-makers: The Capital Markets Authority, Financial Reporting Center, National Treasury, and even Parliament on why your industry deserves the space to breathe.

Lobbying is a learning process on both sides. Regulators are still figuring out how to frame crypto, while industry players are learning how to present their case without being boxed into definitions that don’t fit.

The 2025 VASP Bill was a huge milestone. Kenya’s grey-listing helped open the door to finally talking about crypto in the open.

Kenicoin showed us what’s at stake. Drafting regulations meant going all the way through Parliament.

Participate

Lobbying isn’t cheap or easy. It takes years of consistent effort, industry-wide alignment, and yes, funding. If you want your voice to be heard, you’ve got to be willing to contribute.

But at its best, lobbying is about reaching agreement: are we treating crypto as an asset? as money? Or are we banning it outright? Your positioning matters, and so does your participation.

Decisions are deals & the best deals are made after hours

Let’s be real. Regulators are human. You are pushing ideas to a human who has a price. So yes a lot of lobbying happens after office hours. The late-night conversations over wine, a trip to Kilifi…. You know, this is a person who is going to make a decision in the morning.

Let’s call it Facilitation fees. Just It’s how persuasion has always worked. Lobbying isn’t about skewing the law in favor of a few, it’s about fast-tracking the conversation so the market gets clarity sooner.

Kenya is a true democracy

There will always be bigger players. There will always be someone with more money, denser networks and more experience. The worst thing you can do as an industry player is not participate. Your voice matters and your point can be the one that sticks with the regulator the most and becomes law. After you are done with the process, there’s power. You’ll learn chuoms you didn’t know & whatever the outcome, it can always change down the line.

Go for it!

DeFi is getting regulated and we’re helping it happen?

Innovation fuels growth. And in a perfect world, currency moves freely, you build what you want & bad actors get punished by the free market.

However, consumers need to be protected. You want somewhere you can follow up from when your grandpa gets scammed off his pension because Agrivest vanished last evening.

Regulation has brought the credibility we need in the blockchain industry. Back in 2015, KRA mentioned that no bank should engage with anything crypto. In an environment like that, going mainstream is impossible. It’s the guardrails that has helped change the perspective effectively opening us to markets we would have never accessed before.

Regulation doesn’t have to suck

You don’t have to regulate every single innovation. The role of a regulator is to ensure an efficient and orderly market—not to stifle progress. Fintech moves fast, and regulators must at least be aware of the pace at which it evolves.

It’s easier than advertised; You don’t have to fear licensing & regulation . It helps to think of it as a checklist: Board governance, AML policy, compliance measures. If you have them, you can get licensed. There isn’t any preferential treatment really, Binance may have backing, but the rules still apply to them too.

In Conclusion

Don’t fear lobbying. You showing up strengthens the industry.

Gina Din lobbying for M-Pesa is a prime example of how generations of lobbyists have shaped Kenya’s financial landscape & just like her, you too.