The Day the Internet Got Its Own Money

It was a cold day in January 2009. Somewhere in the world, a mysterious person or maybe a group pressed a few keys on a computer and quietly changed history. No fireworks. No news headlines. No Wall Street bells ringing. Just a single message written in the first Bitcoin block:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

And with that, the internet officially got its own money.

The Birth of Digital Gold

Before Bitcoin, the idea of digital money wasn’t new – it had just always failed. People had tried things like e-gold and online payment credits, but every attempt had one problem: trust.

You had to trust a company to hold your money. You had to trust they wouldn’t shut down, get hacked, or get seized by the government. And as history shows, trust is expensive.

Then came Satoshi Nakamoto – a mysterious genius (or geniuses) who said, “What if we don’t need trust at all?”

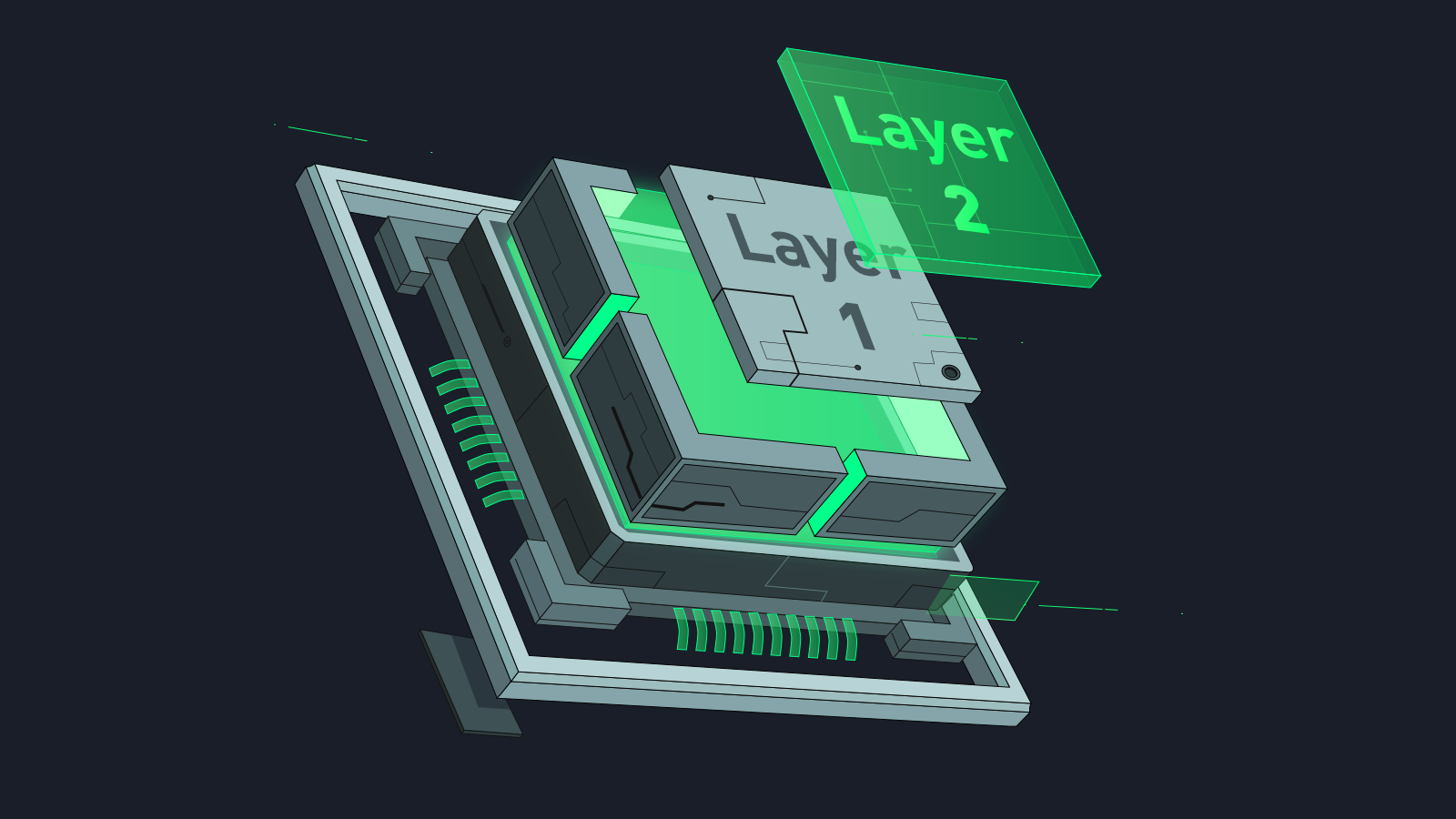

Instead of relying on a bank or company, Bitcoin used something wild called the blockchain – a public digital ledger that everyone could see but no one could secretly change. It was like putting the entire world’s transaction book on the internet, locked behind math instead of men in suits.

And just like that, the internet had created something humans had never seen before: money without permission.

At first, nobody cared. Tech forums had maybe a few hundred people talking about this “weird internet coin.”

In 2010, someone famously used 10,000 BTC to buy two pizzas. This was the first known Bitcoin transaction. That’s now worth hundreds of millions of dollars. Expensive dinner, right? But the point isn’t the pizza. It’s that value moved from one human to another across the internet – without a bank, without a government, and without asking anyone for approval. That tiny moment showed that digital money could actually work.

The Internet Grows Up

The internet used to be all about information. You could send emails, share files, and post cat videos. But you couldn’t send value. Well, not directly. Bitcoin changed that. It made the internet capable of moving not just messages, but money. It turned the web from a library into an economy.

Now, ideas like blockchain, DeFi, and Web3 are building on that same spark. The internet isn’t just where you browse – it’s where you can earn, own, trade, and build wealth. It’s as if the web grew a heartbeat and a wallet.

Not Perfect, But Powerful

Bitcoin wasn’t perfect. It was slow, misunderstood, and often mocked. People called it a scam, a bubble, even “rat poison.” But the thing about revolutions is that they never look like revolutions at first. They start as nerdy experiments in dark corners of the internet and end up rewriting global systems.

Today, governments, banks, and tech giants are racing to catch up. They’re building digital currencies, experimenting with blockchain, and pretending they were always supportive (spoiler: they weren’t).

When money became digital, it changed how we think about value. It stopped being tied to borders or banks. Suddenly, a kid in Nairobi, a student in Kampala, or a developer in Kigali could all participate in a global financial network without permission.

That’s what Bitcoin really started. Not just a new currency, but a new possibility. And it all began quietly, with one line of code and one simple idea that money should belong to the people, not the system.

January 3rd, 2009 wasn’t just another date on a calendar. It was the day the internet stopped being a playground and started being a world of its own. A world where value moves as freely as information, and where the next financial revolution is only a few clicks away.

The internet got its own money that day and the world has never been the same since.