If Banks Were Invented After Blockchain

Imagine a world where blockchain came first where people already send money across the internet in seconds, own digital wallets instead of plastic cards, and trust math instead of middlemen.

Now picture someone trying to pitch a brand-new idea: “We should start something called a bank!”

You can almost hear the laughter.

The Pitch No One Asked For

A nervous entrepreneur walks into a room full of crypto natives. He clears his throat.

“Okay, hear me out,” he says. “What if, instead of controlling your own money on your phone, you gave it all to us?”

The room goes quiet.

He continues, sweating slightly. “We’ll keep your money for you. You won’t have access on weekends, but we’ll let you withdraw during office hours if you show enough paperwork.”

A voice from the back: “Wait, you mean we can’t move our money 24/7?”

“Uh… no, but don’t worry! We’ll give you an app that looks modern, but all transactions still take two to three business days.”

The audience bursts out laughing.

If Blockchain Came First

If blockchain had existed before banks, the concept of banking would sound like a downgrade.

- You control your money? Gone. Now someone else does.

- Instant payments? Forget it. Wait in line.

- Global transfers? Only after high fees and a long approval process.

- Transparency? Nope. Your money disappears into an invisible system, and you just have to trust it’s there.

People who grew up with blockchain wallets would find banking ancient — like using a fax machine to send a meme.

“We’ll Keep Your Money Safe”

The banker continues his pitch:

“You can’t actually see where your money goes but trust us, it’s in good hands. And if we make mistakes, we might lose it or freeze your account. But hey, we’ll send you an apology letter.”

A blockchain believer raises an eyebrow. “Can’t I just verify everything myself on the blockchain?”

“Well,” the banker stammers, “we prefer to handle the records privately.”

“In other words,” the audience says in unison, “you want us to believe you without proof.”

Exactly.

The Problem Blockchain Solved

The funny thing is, this isn’t far from how traditional finance works today.

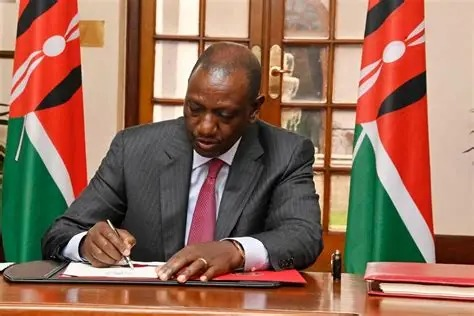

For centuries, people had to trust banks because there was no other way. The idea of a public, tamper-proof ledger seemed impossible. But blockchain changed that.

Now, money can move directly from person to person, anywhere in the world, without a middleman keeping score. The blockchain is the scoreboard that is open, global, and fair.

That doesn’t mean banks are evil or useless. It just means they were a solution for a world that didn’t yet have blockchain.

If banks were invented after blockchain, they’d have a tough time convincing people to give up control.

We’d laugh at the idea of waiting days for payments or paying fees just to move our own money. We’d question why a small group of people should control what the rest of us can or can’t do with our finances.

But in reality, we’re living through that transition right now — from the bank-first world to the blockchain-first future.

And one day, when our grandchildren hear that people once waited three days for a transaction to clear, they’ll probably say,

“That sounds like the Stone Age.”

And they’ll be right.