Beyond M-Pesa: & The East Africa’s New Crypto Economy

How Afritokeni, Kotani Pay, and Swypt are building the next generation of inclusive finance from the ground up.

The Gap M-Pesa Left Behind

When M-Pesa launched in 2007, it felt like the future had arrived. A SIM card turned into a bank. A farmer could send money to his son in Nairobi with nothing but a text. The unbanked suddenly had access, liquidity, and dignity, all through a phone that wasn’t even “smart.”

But every revolution leaves unfinished business.

M-Pesa was centralized, its value tethered to an inflationary local currency. You could send money easily, but you couldn’t preserve it. You could move funds across towns, but moving them across borders remained slow and expensive.

That gap, between access and autonomy, is where a new generation of African fintechs is quietly at work. They’re not trying to kill M-Pesa; they’re building around it, through it, and on top of it, using blockchain to layer new capabilities.

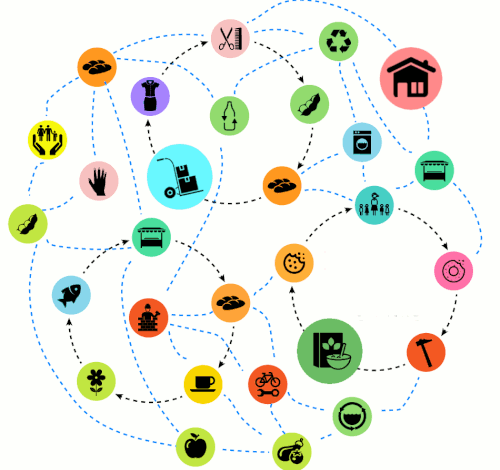

Together, they’re solving three different but deeply connected problems:

- Access: How do you serve people without smartphones or internet?

- Distribution: How do you pay thousands across borders without banks?

- Liquidity: How do you make crypto usable in daily life?

To see this new stack, you have to look at three Kenyan-born ventures: Afritokeni, Kotani Pay, and Swypt. Each is building one distinct layer.

A Three-Layered Solution to East Africa’s Financial Gaps

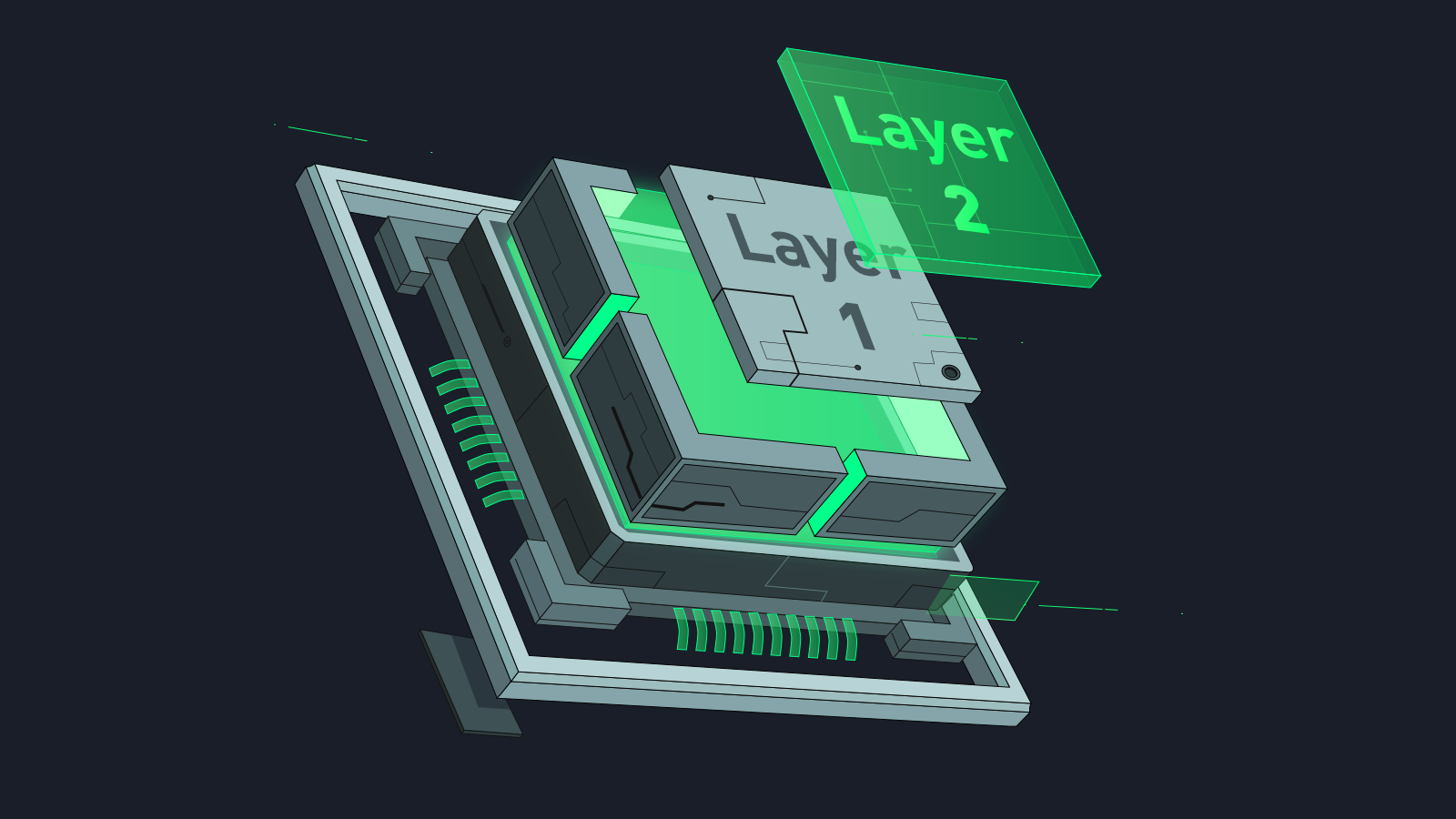

Layer 1: Afritokeni — Decentralized Infrastructure for the Unbanked

In much of rural Africa, a smartphone remains a luxury, and internet coverage is scarce just a few kilometers from major towns. Yet, these are the very regions where currency inflation often has the most severe impact.

Afritokeni’s solution is notable for its simplicity: it delivers blockchain banking to any mobile phone, requiring no applications, data plans, or downloads. By using the universal USSD protocol (*123#), users connect to a decentralized wallet running entirely on the Internet Computer (ICP) blockchain. From this text-based menu, they can manage balances, send funds, or acquire ckUSDC, a stablecoin pegged 1:1 to the U.S. dollar.

The platform’s key innovation is its resilience. By design, there are no centralized servers susceptible to failure or censorship; the entire system operates on-chain. For users, this provides a profound capability: the ability to save in U.S. dollars without needing a bank account, a smartphone, or an internet connection. In economies where inflation silently erodes savings, Afritokeni provides a tool for wealth preservation, accessible via a simple text command.

Layer 2: Kotani Pay — The B2B Middleware Bridge

Where Afritokeni focuses on individual users, Kotani Pay builds for organizations. Its clientele is not consumers, but rather infrastructure players that need to move money reliably at scale: global NGOs, Web3 gig platforms, and cross-border payment firms.

Kotani Pay functions as the “invisible plumbing” of Africa’s blockchain economy. It is a Middleware-as-a-Service (MaaS) platform that connects businesses’ crypto wallets to real-world payout channels. Through its API, a company can send stablecoins like USDC, and Kotani Pay automatically delivers the value to end-users through local payment rails, whether that’s M-Pesa, Airtel Money, or USSD.

To the recipient, it feels like a normal mobile-money deposit. For the business, it abstracts the complexity into a single, borderless transaction powered by blockchain. Kotani Pay’s model addresses a critical logistical puzzle: how to pay thousands of people instantly across fragmented financial systems. In doing so, it is laying the rails for Africa’s next-generation remittance and aid infrastructure.

Layer 3: Swypt — The Last-Mile Liquidity Bridge

While Afritokeni establishes access and Kotani provides distribution, Swypt delivers utility. It provides the critical interface where digital value becomes spendable in the real-world economy.

Swypt’s model is built on the premise that users want to use crypto, not just hold it. Its application allows users to move between stablecoins and local currency with near-zero friction. A user can cash out USDC into M-Pesa, buy airtime, or pay a merchant, all within seconds.

Instead of competing with Safaricom, Swypt integrates directly with its M-Pesa ecosystem. By championing and integrating assets like cKES (a tokenized Kenyan shilling on the Celo blockchain), Swypt anchors stablecoins to a familiar unit of account. This allows people to transact in crypto shillings, backed by transparent, on-chain reserves.

With developer APIs that enable any business to plug crypto payments into e-commerce, Swypt turns blockchain into a tangible financial tool: a payment network with practical, daily-use liquidity.

3. Challenges Ahead

Regulation – The VASP Act

As Gina Din said, before regulation, Safaricom implemented first then asked for forgiveness later. These people conducted a massive, technically illegal financial surveillance experiment on millions of Kenyans and they had the guts to do it before everything was down on paper.

I don’t condone this. But it is important that we keep saying it. That being said….

Kenya’s new Virtual Asset Service Providers (VASP) Act, 2025, which was signed into law just last month, is the biggest variable in this story. It introduces clear licensing, KYC/AML rules, and oversight, all long overdue in a space that grew in regulatory grey zones.

But it’s a double-edged sword. Complying with these requirements could cost startups more than they can afford. For early-stage players like Afritokeni, the capital and reporting demands could slow innovation.

Yet, for scale-ups like Kotani Pay and Swypt, the Act is the legitimacy boost they’ve been waiting for. It provides a framework that allows them to partner with banks, telcos, and even the state itself. The difference between “illegal crypto” and “regulated fintech” will be decided by how fairly this new Act is implemented.

The M-Pesa Moat

Every fintech in Kenya faces the same reality: M-Pesa isn’t just a product; it’s infrastructure. Its agent network of over 300,000 outlets in Kenya alone is an economic fortress, impossible to replicate.

For blockchain solutions to reach scale, users need reliable cash-in/cash-out channels. Without them, digital assets remain digital dreams. That’s why Afritokeni is experimenting with community-based agents: local shopkeepers who double as bridges between cash and ckUSDC. It’s a slow, grassroots model, but it’s the only one that can build a truly decentralized physical network.

The Trust Gap

Technology can be built overnight. Trust cannot. Convincing people that a “canister on a blockchain” is as safe as a Safaricom account will take time, education, and proof.

There’s also the perception problem: to many, “crypto” still means speculation and scams. The challenge is reframing it as a tool. A tool for saving, for payments, for protection, not as a gamble.

These aren’t technical barriers; they’re human ones. But every major fintech leap in Africa, from M-Pesa on, started by solving precisely that trust gap.

4. The Future

The Bright Side – Integration

I like to imagine a future where a designer in Nairobi finishes a freelance job for a U.S. client and gets paid in USDC. She instantly swaps part of it for cKES on Swypt, pays her landlord via M-Pesa, and sends 20% to her mother in Kisumu.

Her mother, using Afritokeni’s USSD code on a simple feature phone, converts that money into ckUSDC, saving it in dollars to avoid inflation.

Behind the scenes, Kotani Pay’s infrastructure moves value seamlessly across platforms. No bank. No borders.

The Shadow Side – Stagnation

But innovation can also die in the cracks between systems. In a darker timeline, regulation turns punitive. M-Pesa, seeing a threat, blocks interoperability. Users remain skeptical.

Blockchain stalls, becoming a niche luxury for the urban elite, and the promise of decentralized finance fades back into the hype cycle. Kenya, once again, would be first to invent but not first to scale.

In Conclusion

Afritokeni, Kotani Pay, and Swypt are not just startups. Right now, in real time, we are getting to experience the story of how East Africa concurred inflation, embraced oppennes & chartered interoperability on its people’s finances.

They aren’t competitors per se, rather, each one addresses a different fault line in the current system:

- Afritokeni brings access.

- Kotani Pay brings infrastructure.

- Swypt brings liquidity.

Their success will depend on whether regulators, users, and incumbents can coexist within this new model.

And it is important that they make it. Because or the first time, the tools to build a decentralized, inclusive, and resilient financial system aren’t in Silicon Valley. They’re being built in Kenya.

And congratulations to AfriTokeni for coming 3rd in WCHL. We wish you all the best!