Is the World Ready for Bitcoin as Legal Tender?

Imagine paying taxes, school fees, or buying food using Bitcoin instead of national currency. For some, this sounds like the future of money. For others, it sounds risky and unrealistic. Since Bitcoin was created without any government control, the idea of making it official legal tender challenges how money has worked for centuries. The question is no longer whether Bitcoin exists, but whether the world is truly ready to treat it as official money.

What Does Legal Tender Mean?

Legal tender is the official money that a government says must be accepted for payments. It is the money you can legally use to settle debts, pay taxes, and buy goods and services within a country.

In simple terms, legal tender is the money that everyone recognizes as valid by law.

For example, in Kenya, the Kenyan shilling is legal tender. If you owe someone money, they cannot refuse payment made in Kenyan shillings. The government also accepts it for taxes, fees, and public services.

Legal tender exists to create trust and order in the economy. It ensures that there is a common form of money everyone agrees to use. This makes trade, salaries, loans, and taxes possible without confusion.

It is important to understand that legal tender is not about whether people like a currency. It is about what the law recognizes as official money. Even if people prefer digital payments or mobile money, those systems still rely on legal tender in the background.

When people ask whether Bitcoin can be legal tender, they are really asking whether governments could officially recognize Bitcoin as money that must be accepted for payments, just like national currencies.

This is a big shift, because legal tender has traditionally been controlled by governments and central banks.

What Is Bitcoin?

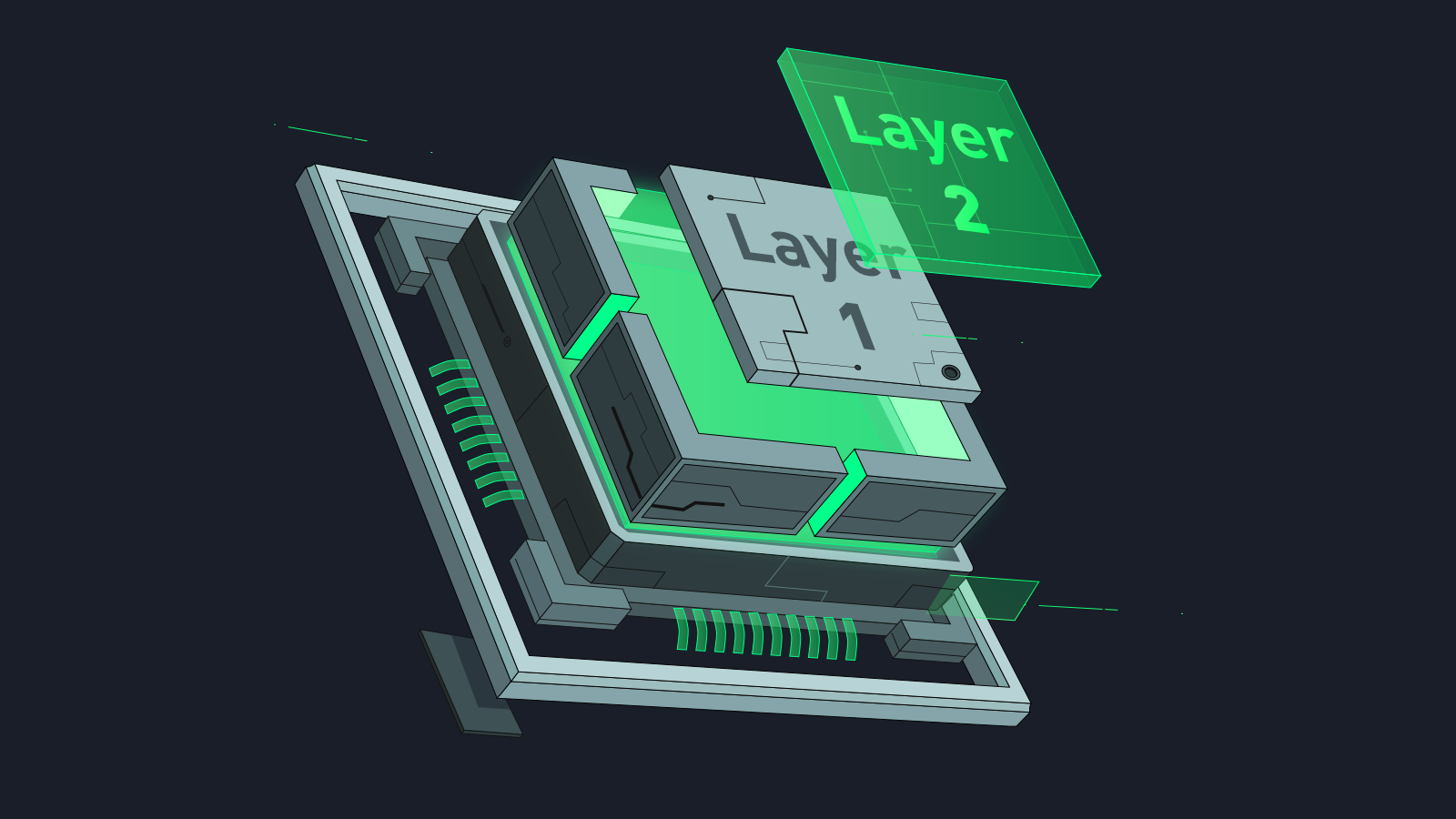

Bitcoin is digital money that works without a government or central bank. It was created to allow people to send money directly to each other over the internet, without using banks or payment companies.

Bitcoin exists only online. There are no paper notes or coins. Instead, ownership is recorded on a public digital record called the blockchain. This record shows who owns what, and it is shared across many computers around the world.

One key idea behind Bitcoin is that no single person or institution controls it. The rules are built into the software. New bitcoins are created at a fixed and predictable rate, and there will never be more than 21 million bitcoins. This limited supply is why many people compare Bitcoin to gold.

Bitcoin can be sent across borders easily. You do not need permission from a bank, and transfers can happen at any time. This makes it attractive in places where banking services are slow, expensive, or hard to access.

However, Bitcoin’s price can change a lot in a short time. This makes it risky to use as everyday money. Many people today see Bitcoin more as a store of value than something they use to buy daily items.

Bitcoin is:

- Digital

- Decentralized

- Limited in supply

- Global

These features are what make Bitcoin interesting, and also what make the idea of it becoming legal tender both exciting and controversial.

Why Governments Fear Bitcoin

Governments fear Bitcoin not because it is noisy or rebellious, but because it quietly removes something they have always controlled. Money has long been one of the strongest tools of power. Through money, governments manage economies, fund projects, control inflation, and respond to crises. Bitcoin challenges this control without asking for permission.

With traditional money, governments can print more when they need to. This ability helps them pay debts, support failing industries, or respond to emergencies. Bitcoin does not allow this. Its supply is fixed, and no authority can change that rule. For governments, this feels like losing a steering wheel while still being expected to drive the economy.

Bitcoin also moves outside the usual financial gates. Traditional systems pass through banks, regulators, and reporting structures. Bitcoin allows people to send value directly to one another. This makes it harder for governments to track transactions, enforce capital controls, and monitor the flow of money. For authorities used to seeing everything, this lack of visibility creates discomfort and fear.

Taxation is another concern. Governments rely on taxes to function. When money moves in ways that are difficult to observe or control, collecting taxes becomes more challenging. Even if people are willing to pay, the system itself feels unfamiliar and harder to manage.

There is also fear of losing relevance. National currencies are symbols of sovereignty and identity. They carry history, authority, and national pride. Bitcoin does not belong to any country. It does not fly a flag or sing an anthem. For governments, accepting Bitcoin as legal tender can feel like sharing authority with something they did not create and cannot command.

Finally, Bitcoin exposes weaknesses. When people turn to Bitcoin, it is often because they no longer trust their local currency or financial system. This is uncomfortable for any government. Bitcoin becomes a quiet signal that something is broken. Rather than fixing the root problems, it can feel easier to resist the alternative.

In the end, governments do not fear Bitcoin because it is dangerous on its own. They fear it because it changes the balance of power. It shifts control from institutions to individuals, from central decisions to personal choice. And for systems built on control, that shift is deeply unsettling.

Countries That Have Tried Bitcoin as Legal Tender

So far, very few countries have officially tried to make Bitcoin legal tender. This shows how big and risky the decision is.

The most well known example is El Salvador. In 2021, El Salvador became the first country in the world to make Bitcoin legal tender. This meant that Bitcoin could be used alongside the US dollar, which was already the country’s main currency.

The government said the goal was to:

- Help people without bank accounts

- Make remittances cheaper

- Attract foreign investment and innovation

To support this, the government introduced a digital wallet and encouraged businesses to accept Bitcoin.

However, the results have been mixed. Some people and businesses adopted Bitcoin, but many continued to prefer cash and dollars. Price volatility made people cautious, and technical issues affected early adoption. Over time, Bitcoin use for daily payments remained limited for most citizens.

Another example is the Central African Republic, which announced Bitcoin as legal tender in 2022. However, the move faced strong challenges, including limited internet access and public understanding. The country later reduced the role of Bitcoin in its monetary system, showing how difficult implementation can be.

These examples show that declaring Bitcoin legal tender is only the first step. Real success depends on infrastructure, public trust, education, and economic stability.

So far, no country has fully proven that Bitcoin works smoothly as legal tender for everyday life.

Why Some Countries Consider Bitcoin as Legal Tender

Some countries consider Bitcoin as legal tender because they face serious economic challenges and are looking for alternatives to traditional money systems.

One reason is high inflation. In some countries, the local currency loses value very quickly. Prices keep rising, and people struggle to save money. Bitcoin has a fixed supply, so governments and citizens see it as a possible way to protect value over time.

Another reason is weak or unstable national currencies. When people lose trust in local money, they often turn to foreign currencies or informal systems. Bitcoin offers a global option that is not controlled by any single country.

Financial inclusion is also a key factor. In many developing countries, large parts of the population do not have bank accounts. Bitcoin can be used with just a phone and internet access, allowing people to send and receive money without relying on banks.

Remittances are another motivation. Many countries depend heavily on money sent home by citizens working abroad. Traditional remittance services can be slow and expensive. Bitcoin allows money to be sent across borders quickly and with lower fees.

Some governments also see Bitcoin as a way to reduce dependence on foreign currencies, especially the US dollar. By adopting Bitcoin, they hope to gain more financial independence and attract global attention, investment, and tourism.

In simple, countries consider Bitcoin as legal tender because they are searching for solutions to inflation, exclusion, high transfer costs, and limited financial control. Whether Bitcoin can truly solve these problems is still an open question.

The Biggest Challenge: Volatility

One of the biggest challenges with Bitcoin is how often its price changes. One day it can be very valuable, and the next day it can lose a large part of that value. For ordinary people, this creates fear and uncertainty.

Imagine receiving your salary today, feeling secure, and then waking up the next day to find that your money is worth much less. This is not how people expect money to behave. Money is meant to be stable and predictable. Because Bitcoin can rise and fall so quickly, it becomes difficult to use it for everyday needs like food, rent, or transport.

Until Bitcoin becomes more stable, many people will continue to see it as risky rather than reliable.

Education Is a Major Missing Piece

Another major issue is understanding. Many people simply do not know how Bitcoin works, and this lack of knowledge creates fear.

People often ask simple but important questions. What happens if I press the wrong button? What if my phone gets lost? Who helps me if something goes wrong?

With Bitcoin, the user is responsible for their own money. There is no bank to reverse a mistake or recover lost access. For people who are used to banks handling everything in the background, this feels overwhelming.

Without proper education and simple explanations, large scale adoption of Bitcoin becomes risky and stressful for everyday users.

Infrastructure Still Matters

Bitcoin does not exist in isolation. It relies on basic infrastructure such as internet access, electricity, and smartphones.

In many parts of the world, these basics are not reliable. Internet connections can be slow or too expensive. Power outages are common. Some people share phones or use old devices that cannot support modern apps.

Cash, on the other hand, works even when there is no power or internet. This makes it hard for Bitcoin to fully replace cash in these environments. Any serious discussion about Bitcoin as legal tender must consider these realities.

Are Businesses Ready?

usinesses think in practical terms. They need stable prices, simple accounting, and predictable income to survive.

Bitcoin makes this difficult because its value changes often. Pricing goods becomes complicated when the value of money is unstable. On top of that, accounting rules for Bitcoin are still unclear in many countries. Tax treatment differs from place to place, and the tools used to manage Bitcoin payments are still improving.

Until accepting Bitcoin becomes as simple and predictable as accepting cash or mobile money, many businesses will remain cautious.

Emotional Readiness and Trust

Money is not just a tool. It is emotional. People trust what they know and what they have used all their lives.

For many people, cash feels real because they can hold it in their hands. Bitcoin feels invisible because it exists on a screen. This difference matters more than many people realize.

Trust takes time to build. Older generations often struggle with digital money, while younger people may see Bitcoin more as an investment than something to spend daily. Until Bitcoin feels familiar and safe, emotional resistance will remain.

What Bitcoin as Legal Tender Really Means

Bitcoin becoming legal tender is not about replacing all existing money overnight. It is about offering people a choice.

It gives people an alternative when local money fails. It creates competition for currencies that lose value quickly. It offers protection in places where financial systems do not work well.

Bitcoin works best when it is optional, not forced.

A More Likely Future

The most realistic future is not one where Bitcoin replaces all money. A more likely outcome is a world where Bitcoin exists alongside local currencies.

People will choose when it makes sense to use Bitcoin and when it does not. Governments will learn to regulate rather than ban. Education will improve slowly over time.

Some countries will move faster. Others will watch, learn, and wait.

So, Is the World Ready?

From a technology point of view, the world is mostly ready.

From a political point of view, it is not fully ready.

From an economic point of view, readiness exists only in certain countries.

From a social and emotional point of view, the world is not there yet.

What we are seeing today is a global experiment. People, businesses, and governments are learning, adjusting, and slowly finding their way forward.