Sarafu: How Kenyan Communities Turned Blockchain into Survival

Kenya’s crypto scene has always been… something else. When we’re not fighting National scam coins, we’re in a WhatsApp or Telegram group hyping our friend’s new memecoin that’s “about to revolutionize the industry.”

She’s been saying that for three years now. And apparently, it’s still about to be bullish. So you better get in early.

But every so often, amid the hype and the hustle, something different takes shape.

Beyond the traders chasing charts and the dreamers promising moonshots, there are farmers, women’s groups, and youth collectives using the same blockchain rails to keep their communities alive when cash disappears.

Same tech. Two completely different stories.

This is the tale of Kenya’s crypto paradox: the noise of speculation, and the quiet genius of Sarafu, a digital currency built not for profit, but for resilience.

Blockchain for Social Good: The Sarafu Solution

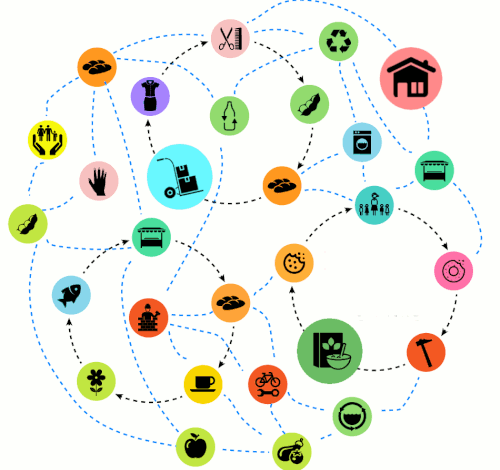

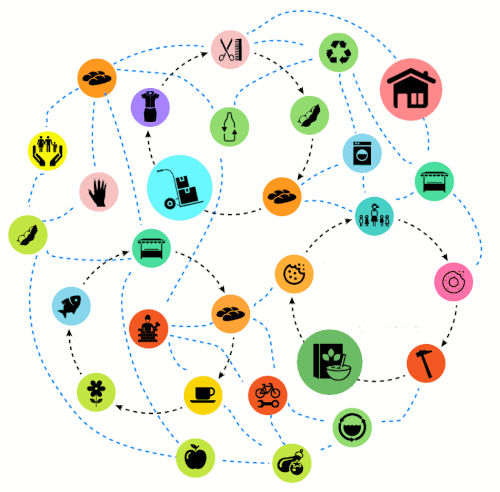

Far from the noise of trading chats and price charts, a quieter experiment has been unfolding in Kenya. Sarafu, a project by the Grassroots Economics Foundation, runs on a simple idea: when cash runs dry, communities can create their own way to trade.

It all starts with the basis that every village already has value.

Farmers with maize, tailors with clothes, shopkeepers with stock. However, what’s often missing is liquidity. Sarafu lets people back digital credits with what they can offer, allowing those credits to circulate locally as a kind of shared promise.

Notice that this is not a replacement for the shilling. It’s essentially just a buffer that keeps local trade moving when the wider economy slows down.

Sarafu began as paper vouchers in Mombasa’s informal markets back in 2010. I didn’t know about them back then, but somehow, I miss that. They then moved to blockchain in 2018.

During the COVID lockdowns, it became a lifeline as thousands used it to buy food when cash stopped flowing. Today, it still powers trade among small businesses and cooperatives across the country.

Trust.

The Innovation: Tech Built for Inclusion

Sarafu’s strength isn’t in fancy apps or tokenomics. It’s in how ordinary it feels to use. If you went to Eth Safari, I know you saw the wristband credit cards.

Members don’t need smartphones or internet. They just dial a short USSD code, the same way they would send an M-Pesa payment, to trade credits instantly. Each transaction is recorded on the Celo blockchain, chosen for its low fees and transparency.

That simplicity is what makes it work. People in rural areas, far from stable networks or banks, can still join a digital economy on their basic phones.

The model is open source too. Communities can copy the blueprint, set up their own pools, and issue local vouchers. One system, many local economies, all trading digitally and rooted in place.

Proof in the People

In towns like Bangale, traders still talk about how Sarafu credits kept markets alive when shillings vanished. Women’s groups, who make up most of the users, say it helped them buy food, pay school fees, and plan ahead.

Independent evaluations by Grassroots Economics and the Red Cross found that each dollar of outside input created up to 21 times more local trade, thanks to the way credits keep circulating. The more people trade locally, the more resilient their communities have become.

Each transaction leaves a trace, not just on-chain but in how people trust each other again.

In Conclusion

Kenya’s blockchain story mirrors its people: inventive, restless, resourceful. The same technology that fuels digital gambling can also fuel digital solidarity.

Here, in small markets, women’s cooperatives, and village councils, blockchain isn’t a buzzword but a bridge.

I love to see these things. Right now, you can go and launch your own Community Asset Voucher on the Sarafu Network and see what we’re talking about.

But maybe, just before you do that, tell your memecoin founder friend that we love them, and they too can change the world some day. All it will take is that one big bull run. 😅

Sources and Further Reading

- Grassroots Economics Foundation — Sarafu Network Overview & Impact Reports (2024) grassrootseconomics.org

- The Kenyan Wall Street — “Grassroots Economics Moves Sarafu Network to Celo Blockchain” (2023)

- Frontiers in Blockchain — Community Inclusion Currencies: A Foundation for Financial Resilience (2021)

- Trust.org / Reuters Foundation — “Kenya’s Blockchain Tokens Help Poor Survive COVID-19” (2021)

- Chainalysis — Global Crypto Adoption Index 2024

- Celo Foundation — Celo in Kenya: Building Inclusive Finance Through Blockchain (2023)