East Africa’s Digital Finance Future: Kenya vs Uganda

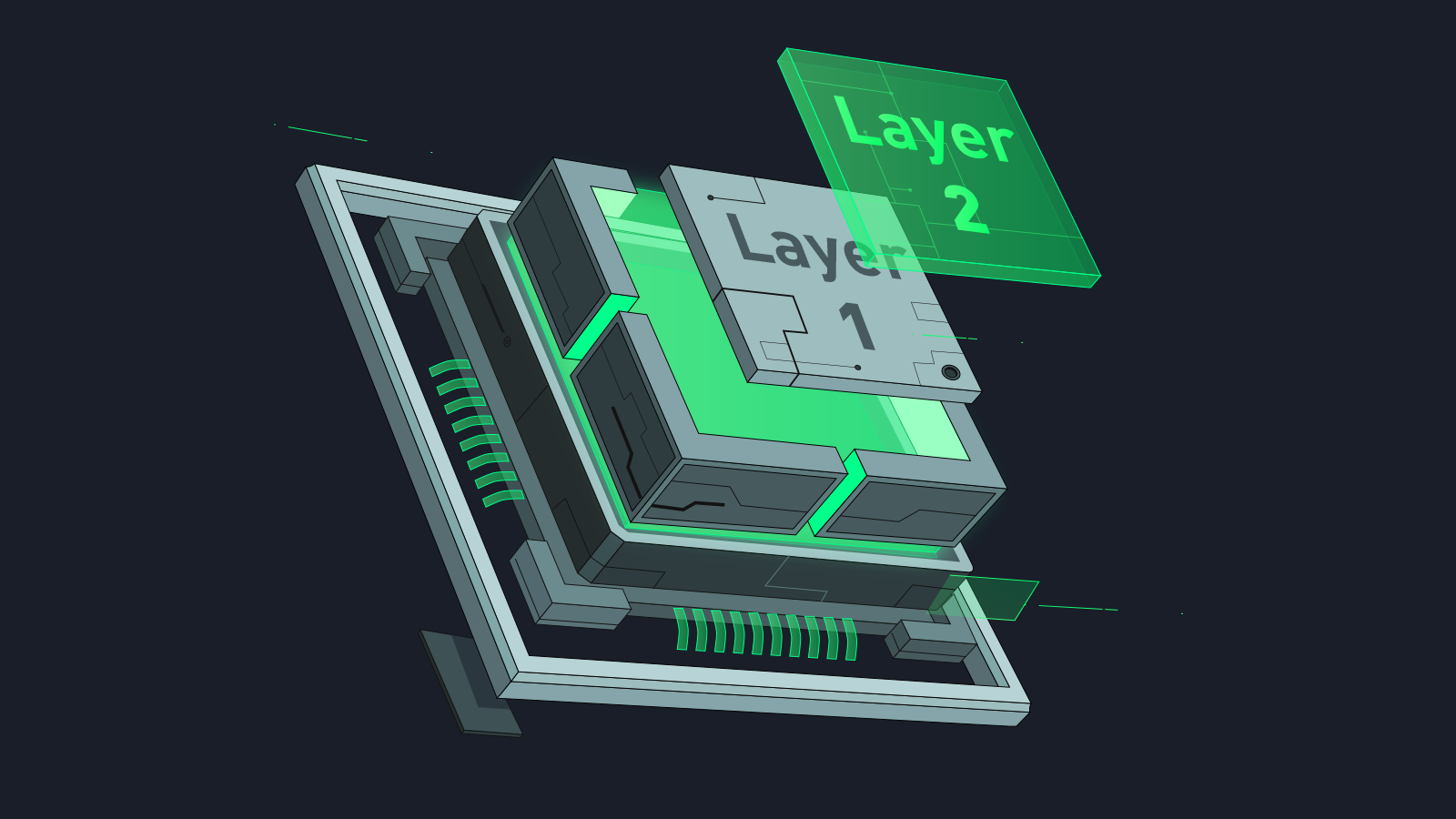

While Kenya has chosen to regulate and formalize its already active crypto and fintech sector, Uganda is taking a state-led approach. It is seeking to build a new digital economy from the ground up, anchored in tokenized real-world assets and a Central Bank Digital Currency (CBDC).

This divergence is more than a difference in policy design. It is a live experiment in how African economies might build digital financial systems that balance innovation, stability, and inclusion.

Lets take a closer look.

Kenya’s Strategy: Regulating an Existing Market

The Virtual Asset Service Providers (VASP) Act, 2025 was a comprehensive framework designed to bring order, trust, and transparency to one of Africa’s most vibrant crypto markets.

The meat and potatoes were:

- A Dual-Regulator Oversight: The law divides supervisory responsibility between the Central Bank of Kenya (CBK) and the Capital Markets Authority (CMA). The CBK oversees payment and custody-related activities (like wallets), while the CMA regulates investment-related activities, such as token issuance and trading platforms.

- Industry Guardrails: The Act introduces core regulatory standards for virtual-asset operators: mandatory licensing, “fit and proper” tests for directors, minimum capital requirements, and the segregation of client assets. These measures are intended to enhance market integrity and protect consumers.

- It is Foundational, Not Final: Importantly, the Act establishes the framework, not the full set of rules. The National Treasury will issue subsidiary regulations detailing how stablecoins, tokenized assets, and capital thresholds will be governed.

Kenya’s approach prioritizes regulatory clarity over prohibition. By recognizing virtual assets and bringing them under formal supervision, the government aims to attract legitimate global exchanges, fintech investors, and developers. The broader vision is to integrate digital assets into Kenya’s well-established mobile-money ecosystem, effectively creating a bridge between domestic financial inclusion and global capital markets.

Uganda’s Strategy: Building a New Digital Economy

In contrast, Uganda is attempting to construct an entirely new financial ecosystem—one that embeds tokenization, infrastructure financing, and a central bank digital currency into its core economic strategy.

Key Initiatives:

- Tokenizing Real-World Assets (RWAs): A partnership between the Global Settlement Network (GSN) and Uganda’s Diacente Group aims to bring approximately $5.5 billion worth of infrastructure, energy, and agricultural assets onto the blockchain. This represents one of Africa’s largest attempts to tokenize tangible national wealth.

- Central Bank Digital Currency (CBDC) Pilot: At the core of this framework is the proposed “digital shilling,” a state-issued and treasury-backed CBDC that will serve as the settlement instrument within this tokenized economy.

- Industrial Integration: The initial rollout is centered on the Karamoja Green Industrial and Special Economic Zone (GISEZ), directly linking digital finance with Uganda’s industrial development agenda under its “Vision 2040.”

- Inclusion via USSD: The pilot includes USSD-based functionality, allowing access through basic mobile phones. This design acknowledges the realities of Africa’s digital divide and aims to make CBDC use feasible for all socioeconomic groups.

Uganda’s model is state-centric and developmental in its orientation. Rather than relying on existing retail crypto activity, it seeks to attract long-term institutional capital by grounding its digital economy in real-world assets. The goal is to ensure that digital transformation aligns with national industrial and financial inclusion objectives.

| Feature | Kenya (Market-Led Model) | Uganda (State-Led Model) |

| Primary Focus | Formalize and regulate existing crypto/fintech markets. | Build a new digital economy anchored in tokenized infrastructure. |

| Core Components | Exchanges, wallets, stablecoins, VASP licensing. | CBDC, tokenized RWAs, and state-driven platforms. |

| Approach | Bottom-Up: Enable private-sector innovation. | Top-Down: Execute through public-private partnerships. |

| Key Risks | Overregulation could limit innovation; regulatory gaps. | Bureaucracy; low user adoption; execution failure. |

| Potential Upside | Rapid growth; attracting agile crypto capital. | Stable, inclusive, and asset-backed development. |

Regional and Continental Implications

This policy divergence carries wider implications for the African continent, which is still defining its approach to digital assets.

- Two Entry Points for Investors: Kenya offers exposure to a fast-moving fintech environment that prioritizes agility and entrepreneurship. Uganda, on the other hand, provides a gateway for investors interested in asset-backed, infrastructure-oriented blockchain projects.

- From Speculation to Utility: Uganda’s emphasis on RWA tokenization highlights a broader global shift in the blockchain’s focus, moving from speculative crypto trading toward productive, real-economy use cases.

- Competing Philosophies: Kenya’s market-led model prioritizes openness and experimentation but must manage volatility and consumer risk. Uganda’s model offers greater order and inclusion but may face delays and limited flexibility.

- Regional Leadership: Both countries aspire to become East Africa’s digital-finance hub. Kenya leverages its M-Pesa legacy and first-mover advantage, while Uganda’s infrastructure-led strategy could yield more sustainable, long-term outcomes if execution succeeds.

Key Risks and Uncertainties

For Uganda: The success of its tokenization program will depend on execution capacity, transparency, and adoption beyond pilot zones. Without clear governance, there is a risk of stagnation or limited uptake.

For Kenya: The implementation of the subsidiary regulations will determine whether the VASP Act fosters innovation or imposes prohibitive barriers. Excessive compliance costs or delayed clarity could stifle early momentum.

For Both: Structural challenges remain: Digital literacy gaps, smartphone access limitations, and the integration of large informal economies. Uganda’s USSD-based model may mitigate some of these, but broader ecosystem readiness is critical.

Kenya and Uganda are running a live experiment in digital finance: Kenya is regulating its existing market, while Uganda is creating one from scratch. Their contrasting approaches, market-led versus state-directed, will shape not only East Africa’s competitiveness but also how the continent balances innovation, inclusion, and trust in the digital age.

In Conclusion

So, which strategy is better?

Kenya is betting that the market, once given clear rules, will build the future. Making it the preferred choice today for agile crypto startups, VCs, and traders. Uganda, meanwhile, is betting that the state, by building the right infrastructure, can create the future: A patient, top-down model that aims to be better tomorrow for farmers in Karamoja, large-scale infrastructure investors, and central bankers focused on mass inclusion.

Personally, Kenya. Let me know what you think. Thanks for reading!