Crypto’s Black Friday on a Saturday — and the One-Minute Mystery

In a perfect world, we’d be comemorating Mazingira Day; discussing what Blockchain & AI servers are doing to our water & electricity. But this isn’t a perfect world. One minute you’re Justin Bieber, the next minute, your life’s savings have been wiped out by a Twitter post.

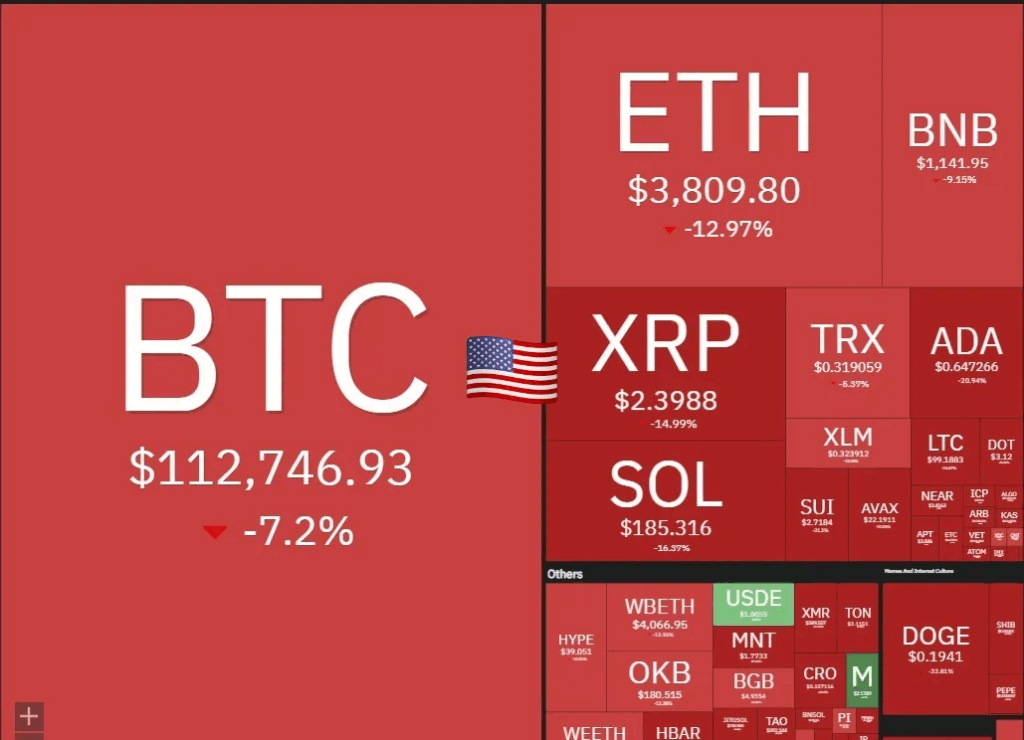

This past weekend was pure chaos. It was loud fast, loud, and historic. We just witnessed crypto’s largest single-day liquidation wave on record. Roughly $19–20 billion in positions were force-closed as thin weekend liquidity collided with Washington’s new 100% tariffs on “critical software.” The spark was geopolitical; the fire was leverage.

October 10 wasn’t a dip. It was a detonation. In minutes, more than $7 billion vanished as the largest single-day liquidation in crypto history ripped through weekend markets. Binance bragged of $250 billion in trade volume with just $2 billion in liquidations and a $14 billion open-interest cliff. Hyperliquid, meanwhile, saw $30 billion in volume and roughly $10 billion flushed. This is the kind of ratio that makes Binance’s numbers smell like they’ve been through a rinse cycle. With different engines and different optics, people are suspecting that while Hyperliquid is bleeding on-chain, Binance is probably bruising in private.

The One-Minute Whisper

And because crypto chaos never travels alone, Coffeezilla added spice to the mix. He spotlighted an account that opened massive shorts on Hyperliquid one minute before Trump’s Truth Social tariff post. The timing was surgical. and with the obsene profits, there is good reason to believe that this was Insider trading. Coffeezilla didn’t have to say it outright; the screenshots said enough. One well-timed trade turned a crash into a conspiracy.

The State of the Market

As of today, the markets have bounced, but the scars remain. Volatility is higher, positions are smaller, and confidence is bruised. It’s a reminder that here, one should only invest what you are cormfortable losing, always have a strategy & it’s a good idea to have savings for buying the dip.

In the end, if you’re prepared, the volatily is just more opportunity.