How Stablecoins Could Redefine Kenya’s Banking Future

Mtaamka mpate wameuza nchi. Somewhere in a grey building along Haile Selasse Avenue, there’s a guy in a suit punching the air right now. Probably.

There’s a quiet shift happening. This one could loosen the Central Bank of Kenya’s grip on the nation’s money. Not through a political coup or a foreign bailout. Stablecoins. Those dollar-backed digital tokens like USDT and USDC, are seeping into emerging markets fast enough to rewrite how value is stored, moved, and trusted.

On October 6, 2025, Standard Chartered dropped a figure that made even regulators sit up: rising stablecoin adoption could pull over $1 trillion out of emerging-market banks by 2028. A tectonic shift in who controls savings, liquidity, and, ultimately, economic power.

In Kenya, the land that turned mobile airtime into money, this hits differently. If M-Pesa gave the CBK sleepless nights, stablecoins might just keep it awake for years.

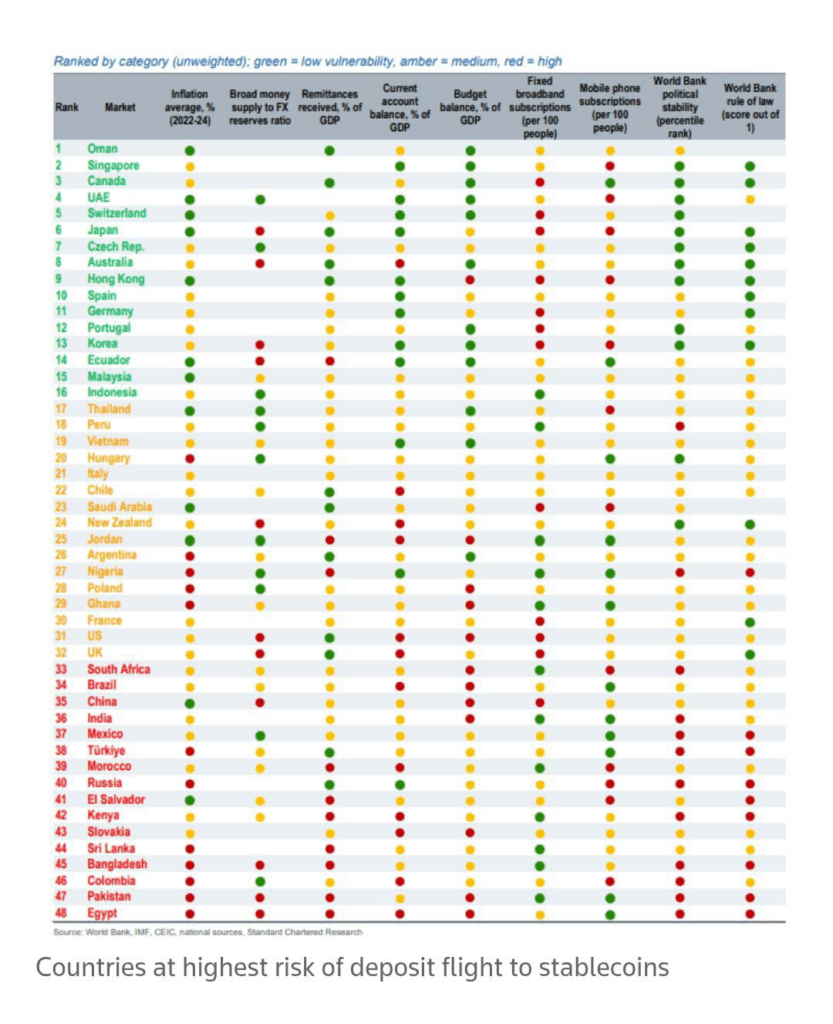

Kenya ranks 42nd globally in vulnerability to such deposit flight; a sign that crypto-dollarization is no longer a fringe issue.

The Coming Shift: $1 Trillion Out of Banks

Standard Chartered’s analysts project that stablecoin holdings in emerging markets could surge from roughly $173 billion today to $1.22 trillion by 2028.

That means nearly a trillion dollars could move out of traditional bank deposits and into crypto-based, dollar-pegged digital currencies; a migration that could fundamentally reshape how money moves, is stored, and is lent.

People in developing economies are tired of watching their currencies lose value. Stablecoins like USDT or USDC let them hold dollar-backed tokens that don’t swing wildly like its Bitcoin, but still move across borders in seconds.

Why Emerging Markets Are Driving the Shift

Emerging markets are fueling this trend for four big reasons:

- Weak local currencies. Inflation and depreciation make stablecoins a safer store of value.

- High remittance costs. Stablecoins slash fees and settle instantly, bypassing SWIFT or MoneyGram.

- Digital familiarity. M-Pesa and mobile money primed millions for wallet-based finance.

- Dollar hunger. People want to save and transact in a stable currency without foreign-exchange drama.

The Global Context

Standard Chartered forecasts that the worldwide stablecoin market could hit $2 trillion by 2028, with emerging markets accounting for about two-thirds of that demand.

By contrast, J.P. Morgan offers a more conservative take, estimating only about $500 billion in stablecoins by then. Their reasoning: slow real-world adoption, fragmented regulation, and limited institutional usage.

Still, even half a trillion dollars would make stablecoins one of the largest monetary instruments in circulation outside the banking system.

The Kenyan Angle: Opportunity and Risk

For Kenya, a country that pioneered digital finance through M-Pesa, this shift could go two ways.

On one hand, stablecoins could expand financial inclusion, offering cross-border access to dollars and faster, cheaper payments. They could make global commerce seamless for freelancers, SMEs, and remittance-dependent families.

On the other, the same forces could undermine local banks. If large amounts of deposits move to stablecoins, banks will have less capital to lend, weakening their ability to fund businesses and public infrastructure.

And Because the Central Bank can’t control what it doesn’t issue, if savers lose confidence in the shilling altogether, monetary policy itself could become less effective

What It Means for Startups and People’s Savings

For Startups: A Double-Edged Opportunity

Kenya’s fintech scene could see both a boom and a shake-up.

- Massive Fintech Potential: Startups can now build payment gateways, remittance platforms, and investment apps using stablecoins as their backbone. It’s a cheaper, faster, borderless infrastructure.

- Competitive Pressure: Banks may fight back to retain deposits, while regulators impose new compliance costs. Startups will need to integrate both traditional and crypto rails smartly.

- Global Playing Field: Kenyan fintechs will now compete with global stablecoin platforms. The winners will be those that localize global finance with trust and simplicity.

Startups that treat stablecoins as infrastructure, not ideology, will win.

For Ordinary People’s Savings

Stablecoins could change how Kenyans think about money itself.

- Easier Access to the Dollar: Anyone with a smartphone could hold digital dollars, protecting their savings from inflation. It’s instant, divisible, and borderless.

- Hidden Risks: But stablecoins aren’t insured like bank deposits. If an issuer collapses or loses its peg, savers could lose everything and there won’t be a CBK or Deposit Insurance Fund to intervene.

- Psychological Shift: The more people save in digital dollars, the weaker the perceived value of the shilling becomes. That can quietly accelerate local currency depreciation.

Handled responsibly, stablecoins empower savers. Handled recklessly, they hollow out domestic banking from within.

Kenya’s Path Forward

To harness stablecoins without destabilizing its financial system, Kenya will need a careful balance:

- Protect banks but empower innovation. Encourage collaboration between banks and fintechs instead of confrontation.

- Educate citizens. Make clear that stablecoins are digital assets, not guaranteed deposits.

- License and audit issuers. Require proof of reserves and regulatory oversight.

- Use regulatory sandboxes. Let startups test safely under CBK supervision.

The Bottom Line

Stablecoins will redefine what it means to bank. For Kenya, this could be the next evolution after mobile money: a borderless, programmable layer of finance built on digital trust instead of physical branches.

If embraced smartly, stablecoins could help Kenya export its fintech genius to the world once again.

But if it’s ignored or resisted, the country could wake up one day to find its money and its future living on someone else’s blockchain.